Overview

As Mayor, I am proud to present the adopted budget for the City of Meadows Place for Fiscal Year (FY) 2025-2026.

This budget is a product of extensive collaboration among staff, elected officials, department heads, and citizens. This process, which begins in late spring and continues through summer, involves determining and prioritizing the City’s needs based on past commitments, current obligations, and anticipated challenges. The process involves multiple departmental meetings followed by discussions with myself and Council.

City Council strives to ensure the most effective use of taxpayer dollars. After considering public input, Council may adjust the budget to better align with its objectives. The budget serves as a crucial planning tool, offering direction and guidance to city staff throughout the year. It reflects the goals and objectives established by City Council, adheres to the Meadows Place Vision Statement, and upholds the safety standards expected by our community.

Another part of the budget process is an annual review and adoption of the Capital Improvement Plan 2025-2026 .

Both the Capital Improvement Plan and Budget are available to view, either below, or in the City Secretary’s office.

FY 2025-2026 Adopted City Budget 08.19.2025

Public Hearing Budget Fiscal Year 2025-2026

Public Hearing Tax Rate 2025

2025 Tax Rate Calculation Worksheet from Fort Bend County Appraisal District

2025 – 2026 Capital Improvement Plan

View the 4th Q’25 Budget Report ended 12/31/2025, for FY 2025-2026, 25% complete.

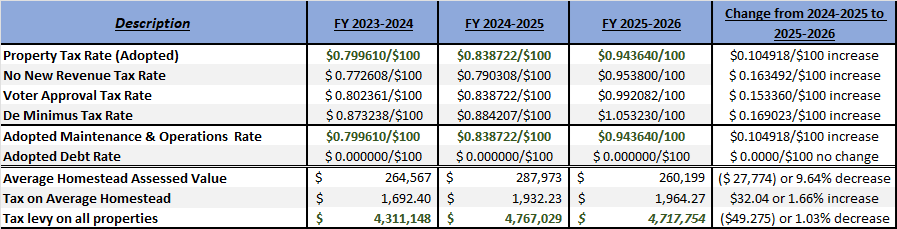

The Adopted 2025-2026 Tax Rate and tax rate comparison for current and prior years are shown in the following chart.

Note: there are no additional MUD, HOA or Levy District taxes in the City of Meadows Place. Total debt obligation for the City of Meadows Place secured by property taxes is $0.

2024-2025 Annual Financial Statement, ending September 30, 2025

2024-2025 Annual Financial Statement Council Presentation 02.24.2026

2024-2025 Adopted City Budget 08.20.2024

Council Meeting 08.13.2024 Tax Rate Presentation

2024 Notice About Tax Rate

2024 Tax Rate Calculation Worksheet 08.02.2024

Click here for more PRIOR YEAR (2024 – 2025) FINANCIAL INFORMATION

View Prior Financial Reports for Meadows Place

View EDC Budgets for Meadows Place