Truth-in-Taxation

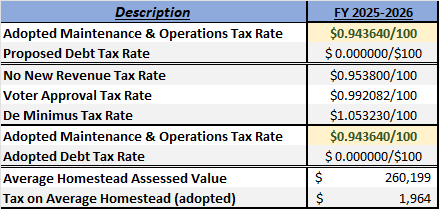

Truth-in-Taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax increases. The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state. The 2020 property tax rate was the first year to implement the new calculations. As a small city of less than 30,000 people, Meadows Place also calculates the de minimus rate.

Public Hearing Notice on Tax Rate to be held 8/19/2025, 6:30 pm

The no-new-revenue tax rate is the tax rate for the 2025 tax year that will raise the same amount of property tax revenue for the City of Meadows Place from the same properties in both the 2025 tax year and the 2024 tax year.

The voter-approval tax rate is the highest tax rate that the City of Meadows Place may adopt without holding an election to seek voter approval of the rate, unless the de minimis rate exceeds the voter-approval rate for the City.

The de minimis rate is the rate equal to the sum of the no-new-revenue maintenance and operations rate for the City of Meadows Place, the rate that will raise $500,000, and the current debt rate for the City of Meadows Place.

The tax rate public hearing for 2025 was August 19, 2025 at 6:30 pm.

For additional details on 2025 Tax Rate Calculations, CLICK HERE.

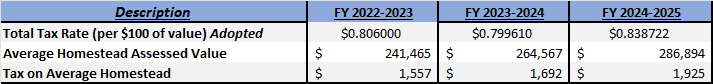

Below are the tax rates from 2022, 2023 and ADOPTED 2024 rate.

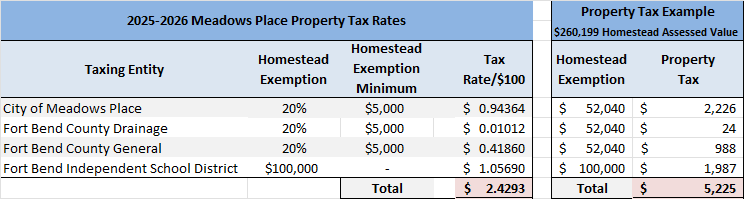

Current Property Tax Rates

Since Meadows Place incorporated in 1983, city leaders have striven to achieve a balance between providing high quality city services to its residents and keeping taxes at reasonable levels.

Taxes for Meadows Place residents per $100 valuation are below. The tax rates are set by each entity and are subject to change on an annual basis

Other possible exemptions are:

- Homestead Exemption: 20%

- Over 65 Exemption: $30,000 *

- Disabled Person Exemption: $30,000 *

- Disabled Veteran’s Exemption: $5,000 to $12,000 **

* In regards to the Over 65 and Disabled Person Exemption, you may only qualify for one $30,000 exemption. Both cannot be applied. However, the one you are eligible for can be combined with the Homestead and/or Disabled Veteran Exemptions.

** The Disabled Veteran’s Exemption ranges from $5,000 to $12,000 based on percent of disability.

Estimating Your City Property Taxes

The following is an example of how to estimate your city taxes using the 2024 proposed rate and the 2024 Assessed Average Homestead property value of $287,973:

| $287,973 | (property value) |

| – $57,595 | (homestead exemption $287,973 * 20%) |

| $230,378 | (taxable property value) |

Now divide the property value by $100 and multiply by the tax rate to determine the estimated city property tax:

| $230,378 $100 | * $0.838722 = $1,932.23 |

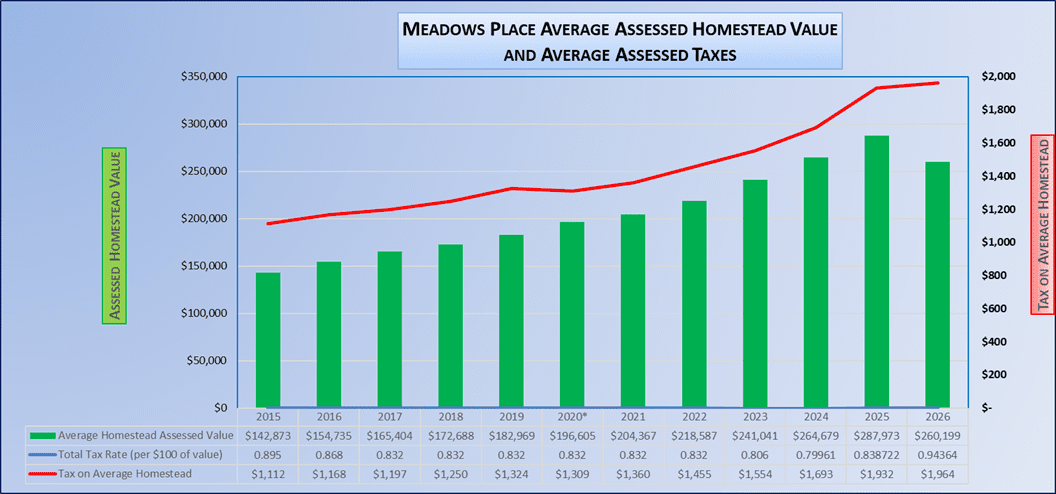

Rising Property Values in Meadows Place

The following chart shows the 12 year trend for average homestead assessed property values and City property taxes per homestead.

Source: Fort Bend Central Appraisal District – for Average Assessed Homestead Value

Tax Tools

The following are links to other taxing entities whose districts include Meadows Place. The City of Meadows Place is not responsible for the information on these websites. If you have questions or need more information about any of these, please contact them directly:

- Fort Bend County Tax Office

- Texas Property Tax Exemptions

- Texas County Data (Property Records)

- Fort Bend County Appraisal District

- Texas Department Motor Vehicles – Vehicle Registration

- Texas Department of Public Safety – Driver’s License

If you have any questions or need more information, please contact City Hall at the numbers below.

Contact Information

| Phone: | (281) 983-2950 |

| Fax: | (281) 983-2940 |